Table of Contents

What Is a Pip?

Unveiling the Power of a single Pip in Forex Trading

What Is a Pip? Over the past few articles, we’ve taken exciting dives into the world of financial markets. But this time, we’re going even deeper—so deep that you might need extra oxygen to hold your breath. Why? Because we’ve reached one of the most crucial concepts every trader must understand: the pip.

As small as it may seem, the pip is the tiny ruler that governs your profits, losses, and overall trading journey. Mastering it is not just useful—it’s essential for anyone who wants to trade with confidence and precision.

Pip Definition

A pip is a short for “percentage in point” or “price interest point”, it is the smallest standardized unit of price movement in the foreign exchange (forex) market. It is the unit traders use to measure and express changes in value between two currencies.

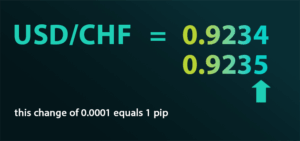

- For most currency pairs, one pip equals 0.0001 (1/100 of 1%), which is the fourth decimal place in a price quote.

- For Japanese yen (JPY) pairs, one pip equals 0.01, which is the second decimal place due to the lower value of the yen.

- Smaller increments than a pip are called pipettes, which are equal to 1/10 of a pip (0.00001 in most pairs, or 0.001 in JPY pairs).

Pips are fundamental in forex trading because they define spreads, price movements, profits, and losses. Traders typically calculate their gains or losses, as well as the bid–ask spread, in terms of pips.

- USD/CHF moves from 0.9234 to 0.9235 → this change of 0.0001 equals 1 pip.

- USD/JPY moves from 110.50 to 110.51 → this change of 0.01 equals 1 pip.

.

What is a pipette?

A pipette is a fractional pip, equal to one-tenth of a pip. Some forex brokers quote prices to five decimal places (or three for JPY pairs) instead of the standard four and two, to give traders more precise pricing.

For example, if EUR/USD moves from 1.08451 to 1.08452, that 0.00001 change represents one pipette.

History of the Pip

-

Pre-1970s:

Currency prices often quoted in fractions (like 1/16 of a cent). No universal “smallest unit.”

-

1970s–1980s:

Electronic forex trading grows → need for standardization. The pip (percentage in point) becomes the unit for price changes.

-

1990s:

Decimal pricing replaces fractions across most markets. Pip officially tied to 4th decimal place (0.0001) or 2nd for JPY pairs.

-

2000s–Today:

Pip becomes universal measure for traders worldwide. Pipettes (fractional pips, 0.00001) introduced for more precise trading.

How Pips Work in the Forex Market

- Most currency pairs → 1 pip = 0.0001 (fourth decimal place).

- JPY pairs → 1 pip = 0.01 (second decimal place).

- Some brokers quote pipettes → 1/10 of a pip (extra decimal place).

- The bid–ask spread is expressed in pips (e.g., EUR/USD 1.1050 / 1.1052 = 2-pip spread).

- Profits and losses are measured in pips (e.g., buy at 1.1050, sell at 1.1060 = +10 pips).

- The pip’s monetary value depends on trade size:

- Standard lot (100,000 units) → 1 pip ≈ $10

- Mini lot (10,000 units) → 1 pip ≈ $1

- Micro lot (1,000 units) → 1 pip ≈ $0.10

- Stop-loss and take-profit levels are often set in pips (e.g., 30-pip stop loss, 50-pip target).

- Using pips makes it easier to compare trades, calculate risk/reward, and manage positions consistently.

Calculating Pip Value

The pip value in forex depends on three main factors:

- Currency Pair: Most pairs use the 4th decimal place (0.0001) to define a pip. Exceptions like JPY pairs use the 2nd decimal place (0.01).

- Position Size: Standard lots equal 100,000 units of the base currency. Traders can also use mini (10,000) or micro lots (1,000) for smaller trade sizes.

- Exchange Rate: The current market rate between the base and quote currency, which fluctuates due to interest rates, trade balances, and investor sentiment.

Formula for Pip Value (standard lot):

Pip Value=Pip Movement×Position SizeExchange Rate\text{Pip Value} = \frac{\text{Pip Movement} \times \text{Position Size}}{\text{Exchange Rate}}Pip Value=Exchange RatePip Movement×Position Size

- Pip Movement: 0.0001 for most pairs, 0.01 for JPY and HUF pairs.

- Position Size: Number of base currency units being traded.

- Exchange Rate: The prevailing rate for exchanging the base into the quote currency.

-

When USD is the quote currency (second in the pair)

- Example: GBP/USD

- Formula: Pip Value = Lot Size × Pip Size

- Pip size = 0.0001

- If you trade 10,000 GBP (mini lot):

- 10,000 × 0.0001 = $1 per pip

- If GBP/USD rises from 1.2705 to 1.2715, that’s a 10-pip move = $10 profit.

-

When USD is the base currency (first in the pair)

- Example: USD/CHF

- Formula: Pip Value = Lot Size × (Pip Size ÷ Exchange Rate)

- If trading a standard lot (100,000 USD) and USD/CHF = 0.9150:

- (0.0001 ÷ 0.9150) × 100,000 = $10.93 per pip

- A move from 0.9150 to 0.9160 = 10 pips = $109.30 profit.

-

JPY pairs (special case)

- Example: EUR/JPY

- Formula: Pip Value = Lot Size × (0.01 ÷ Exchange Rate)

- If trading 100,000 EUR and EUR/JPY = 158.40:

- (0.01 ÷ 158.40) × 100,000 = $6.32 per pip

- A move from 158.40 to 158.50 = 10 pips = $63.20 profit.

The Difference Between a Pip and a Pipette?

| Aspect | Pip | Pipette (fractional pip) | Notes / Example |

| Definition | Standard unit to measure FX price changes | 1/10 of a pip; adds extra precision | Used by many brokers for tighter quoting |

| Size on most (non-JPY) pairs | 0.0001 (1/10,000) | 0.00001 (1/100,000) | EUR/USD from 1.1000 → 1.1001 = 1 pip; 1.10000 → 1.10001 = 1 pipette |

| Decimal place | 4th decimal place | 5th decimal place | Displayed by brokers that quote to 5 decimals |

| JPY pairs (exception) | 0.01 (second decimal place) | 0.001 (third decimal place) | USD/JPY 110.50 → 110.51 = 1 pip; 110.500 → 110.501 = 1 pipette |

| Typical quote precision | 4 decimals (major non-JPY pairs) | 5 decimals (non-JPY) / 3 decimals (JPY pairs) | Fractional pips (pipettes) let spreads be shown more finely |

| Use in spreads & P/L talk | Spreads and P/L commonly summarized in pips | Fine-tunes spreads and order prices by 0.1 pip | Traders still usually speak in pips for risk/result |

| Value on a standard lot (100k units), EUR/USD | ≈ $10 per pip | ≈ $1 per pipette | Rule of thumb when USD is the quote currency |

| Role in risk management | Coarser step for stops/targets (e.g., 20 pips) | Finer step for stops/entries (e.g., 20.3 pips = 203 pipettes) | Pipettes improve precision without changing the core “pip math” |

Importance of Pips

- Forex markets are highly liquid, requiring precise measurement of small price changes.

- Pips standardize these small movements, making them easy to track and compare.

- They are the universal language for spreads, profits, and losses in trading.

- In hyperinflation, pips lose utility as exchange rates move too rapidly.

- Example: Zimbabwe 2008, with monthly inflation over 79 billion percent.

Tips for Using Pips

- Know your pip value before placing a trade.

- Use pips to set stop-loss & take-profit.

- Check the pair’s convention (4 decimals vs. 2 decimals for JPY).

- Watch spreads in pips to control trading costs.

- Pipettes = more precision, useful for scalping.

Wrap-Up

The pip isn’t just another trading term—it’s the foundation of forex trading. Without understanding pips, you can’t properly calculate gains, losses, or manage risk. Even though modern tools can do the math for you, every trader must know how to calculate pips and their value. Mastering this concept is a non-negotiable step before entering the markets.