Table of Contents

What Are Futures?

Your Complete Guide to Mastering the Futures Market

So far, we’ve explored the fundamentals of forex, stocks, and CFDs—each offering unique ways to participate in the financial markets. Now, it’s time to take the next step into another powerful investment instrument: Futures, so what are futures?

Futures trading isn’t just for institutional investors or professional traders. It’s a dynamic and strategic way to diversify your portfolio, manage risk, and even speculate on everything from commodities and currencies to stock indices and interest rates.

In this guide, we’ll break down exactly what are futures? how they work, and why they matter. Whether you’re looking to hedge against volatility or explore new market opportunities, this article will give you the knowledge and clarity you need.

Let’s dive in.

What are futures?

Futures trading is the act of buying and selling futures. These are financial contracts in which two parties (one buyer and one seller) agree to exchange an underlying market for a fixed price at a future date. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future.

Futures: A standardized contract between two parties to buy or sell an asset at a pre-determined price on a specific future date.

- Seller: Commits to sell the underlying asset in the future.

- Buyer: Commits to buy the underlying asset in the future.

Assets Covered in futures trading:

- Commodities (like oil, gold, wheat)

- Index funds and stock indices (like S&P 500 futures)

- Currency pairs (forex futures)

- Cryptocurrencies

- Treasury bonds

- Minerals

Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as

- Stock markets

- Options markets

- Bond markets

Key features of modern futures:

- Standardization:

Each contract is uniform in size, quality, and delivery terms.

- Clearinghouses:

Reduce counterparty risk by guaranteeing trades.

- Leverage:

Enables traders to control large positions with smaller capital.

- High liquidity:

Especially in popular contracts like crude oil, S&P 500 futures, or gold.

Relation between futures and auctions:

A futures market is an auction market in which participants buy and sell commodities and futures contracts for delivery on a specified future date. Originally, such trading was carried on through open outcry and the use of hand signals in trading pits, located in financial hubs such as

- New York

- Chicago

- London.

Why do we call them futures?

Futures trading commonly refers to futures whose underlying assets are securities in the stock market. These contracts are based on the future value of an individual company’s shares or a stock market index like the

- S&P 500

- Dow Jones Industrial Average

- Nasdaq

Futures contracts are traded on a futures market. In such contracts, the contracting parties agree to postpone fulfillment to an agreed date in the future.

Main Types of Futures Traders

-

Speculators:

Trade to profit from price changes; most retail traders fall into this group.

-

Hedgers:

Use futures to reduce risk by locking in prices (e.g. producers or buyers of commodities).

-

Day Traders:

Open and close positions within the same day to capture short-term moves.

-

Position Traders:

Hold trades for longer periods (weeks or months), aiming at long-term trends.

-

Arbitrageurs:

Profit from price differences between markets or contracts with minimal risk.

Future Contracts

- A futures contract is a legal agreement to buy or sell an asset at a set price on a future date.

- Most futures contracts do not result in physical delivery — they are usually closed (offset) before the contract expires.

- Offsetting means taking the opposite position to cancel the original trade.

- Futures are standardized: they specify quantity, quality, and delivery date — only price changes.

- These contracts are traded on futures exchanges (not private deals like forwards).

- Used for hedging: producers/suppliers use them to protect against price changes.

- Traders can sell a contract without owning the asset — they’re just agreeing to deliver in the future.

- The seller can buy back the contract before the delivery date to avoid actual delivery.

- Futures markets are highly liquid and are a major part of the global financial system.

- Different from forward contracts, which are private, non-standard, and cannot be easily offset.

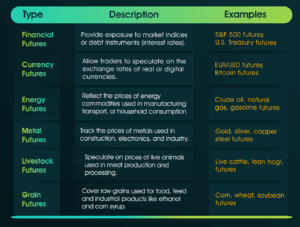

Common Types of Futures Contracts and What They Represent

Futures Contract Standardization

-

Futures contracts are standardized, meaning their terms are fixed and uniform

-

Standardization includes things like contract size, delivery date, asset type, and quality

-

All traders know exactly what they’re buying or selling

-

This removes confusion and lets traders focus only on price

-

It makes the market more transparent and efficient

-

Price movements reflect changes in market expectations, not changes in contract terms

-

Standardization helps the futures market serve as a reliable indicator of future prices

How Futures Contracts Are Standardized

Futures exchanges create clear, uniform rules for every contract to keep trading smooth and fair. They decide:

-

What’s delivered: The type or quality of the asset allowed, and any price changes for lower grades.

-

Where it’s delivered: Approved delivery locations, with possible price adjustments.

-

When it’s delivered: Specific delivery months.

-

How it’s priced: Rules for daily and final price calculation.

-

Contract size: The amount of the asset in one contract—balanced to suit both large and small traders.

-

Limits: Controls on price movement and the number of contracts per trader to prevent manipulation.

Top Regulatory Agencies for Futures Exchanges

Each exchange is normally regulated by a national governmental (or semi-governmental) regulatory agency:

| Country | Regulatory Agency |

|---|---|

| United States | Commodity Futures Trading Commission (CFTC) |

| United Kingdom | Financial Conduct Authority (FCA) |

| Japan | Financial Services Agency (FSA) |

| China | China Securities Regulatory Commission (CSRC) |

| India | Securities and Exchange Board of India (SEBI) |

| European Union (Spain example) | Comisión Nacional del Mercado de Valores (CNMV) |

| Australia | Australian Securities and Investments Commission (ASIC) |

Futures and risk management

Key Risks in Futures Trading and How to Manage Them

- Leverage Risk

- What is it? Leverage can increase your profits — but also your losses.

- How to reduce risk?

- Use stop-loss orders.

- Don’t risk more than 2% of your account on a single trade.

- Market Volatility

- What is it? Futures prices can move suddenly, causing unexpected losses.

- How to reduce risk?

- Diversify your trades.

- Use stop-losses.

- Stay updated with market news and conditions.

- Liquidity Risk

- What is it? Some futures contracts are harder to buy or sell quickly.

- How to reduce risk?

- Trade contracts with high liquidity.

- Use smart order strategies like iceberg orders.

- Basis Risk

- What is it? Futures prices may not always match spot prices, affecting your hedges.

- How to reduce risk?

- Study how futures and spot prices move together.

- Adjust your strategy or use other hedging tools if needed.

The History of Futures Trading

How it all begins?

Futures trading may seem like a modern financial concept, but its origins go back thousands of years. What began as a practical solution for agricultural producers has developed into one of the most powerful financial tools used by traders, investors, and institutions around the world.

Ancient Beginnings: The First Forwards and Futures

- Mesopotamia (circa 1750 BC)

The earliest known form of futures-like contracts can be traced back to ancient Mesopotamia. Clay tablets from Babylonian times reveal that merchants and farmers entered into agreements to deliver goods at a future date for a pre-agreed price. These were forward contracts—the ancestors of modern futures. - Japan – 17th Century Rice Markets (Dōjima Rice Exchange)

One of the first organized futures markets appeared in Osaka, Japan in the 1600s. The Dōjima Rice Exchange was established to standardize the trading of rice contracts. Rice was used as currency, and samurai—who were often paid in rice—needed a way to stabilize their income.

This led to the creation of “rice coupons”, which were essentially futures contracts that promised delivery of rice at a future time.

The Birth of Modern Futures: 19th Century Chicago

- The Chicago Board of Trade (CBOT) – Founded in 1848

The modern futures market officially began in Chicago, a growing hub for American agriculture. During harvest season, there was often a surplus of crops like corn, wheat, and oats, which would cause prices to fall. Farmers and merchants needed a way to lock in prices ahead of time.The CBOT was created as a centralized marketplace where standardized contracts could be traded—offering a way for farmers to hedge against falling prices and for buyers to secure future supply.In 1865, the CBOT introduced the first standardized futures contract for grain. These contracts included details like quantity, quality, delivery time, and location—laying the foundation for all modern futures trading.

Global Expansion and Diversification (20th Century)

- Commodities → Financial Instruments

Originally, futures were only used for agricultural commodities, but over time they expanded to include:- Metals (gold, silver, copper)

- Energy (crude oil, natural gas)

- Livestock (cattle, hogs)

- Softs (coffee, cocoa, cotton)

- By the 1970s, futures markets began trading financial instruments such as:

- Currencies

- Interest rates

- Stock indices

- This marked a revolutionary shift—futures were no longer just for farmers or manufacturers, but now for investors, speculators, and institutions seeking exposure to global markets.

- CME Group Formation

In 2007, the Chicago Mercantile Exchange (CME) merged with CBOT to form CME Group, which became the world’s largest futures and derivatives marketplace. They continued to expand by acquiring the New York Mercantile Exchange (NYMEX) and COMEX.

Why Futures Still Matter?

The core purpose of futures remains the same as it was in ancient times:

- Hedging risk for producers and consumers.

- Speculating on price movements for profit.

- Price discovery that reflects real-time global supply and demand.

Step-by-Step Guide to Start Futures Trading

Step 1- Learn the Basics of Futures

- Understand what futures contracts are and how they work.

- Know the key concepts: margin, leverage, expiration dates, contract size, and tick value.

- Learn the risks involved, such as volatility and potential for amplified losses.

Step 2 – Choose the Right Futures Market

- Commodities: Crude oil, gold, wheat, natural gas

- Financials: Stock indices (e.g., S&P 500), interest rates

- Currencies: EUR/USD, JPY/USD

Step 3- Select a Reputable Futures Broker

- Make sure the broker is regulated and offers access to the futures exchanges you need

- Compare commission structures, platform features, margin requirements, and educational support.

Step 4- Open a Futures Trading Account

- Fill out an application form online.

- Complete KYC (Know Your Customer) process by uploading ID and verification documents.

Step 5- Fund Your Account

- Start with an amount you’re comfortable risking — futures trading involves leverage and can be volatile.

Step 6 -Practice with a Demo Account

- Most brokers offer demo accounts where you can practice trading real market data with virtual money.

- Use this to get comfortable with:

- How orders are placed (market, limit, stop)

- How margin works

- Understanding P&L and position management

Step 7 – Learn to Read Futures Contracts

- Understand specifications like:

- Ticker symbol

- Contract size

- Expiration date

Step 8- Choose a Trading Strategy

- Pick a strategy based on your market outlook and risk tolerance.

Step 9- Track Performance and Adjust

- Keep a trading journal: log your trades, strategies, emotions, and results.

- Regularly analyze what works and what needs improvement.

- Refine your risk management and strategy over time.