Table of Contents

Trading Style VS Trading Strategy

We have come a long way since we started talking about trading and the financial markets, but I think we would be missing something very important if we didn’t talk about trading styles vs trading strategy — how people actually trade, and the different approaches they follow to make decisions in the market. Understanding the difference between these two concepts is essential for anyone who wants to build a clear, consistent, and effective trading plan.

Lets dive in,

Trading Style Vs Trading Strategy

One key area that often gets overlooked is how traders actually trade, their trading style and the strategy they use. These two concepts are often mixed up, yet they define how you approach the market and how you make your trading decisions.

What is Trading Style?

A trading style defines how often you trade and how long you hold your positions.

It’s about your time horizon, pace, and lifestyle fit.

Your trading style depends on your:

- Account size

- Available time

- Personality and patience level

- Risk tolerance

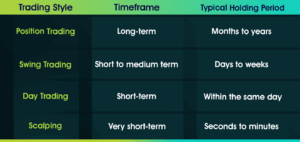

It’s less about technical analysis and more about who you are as a trader. While every trader develops a personal rhythm, most fall into one of four main categories:

What is a trading strategy?

A trading strategy is your specific plan or method for entering and exiting trades.It defines what, when, and why you trade — based on rules and analysis.

A trading strategy is your specific method for deciding when to enter and exit trades.

It defines what you trade, why you trade it, and how you manage risk.

Your strategy is built on rules and analysis, often combining:

- Technical indicators (e.g., RSI, moving averages, Fibonacci levels)

- Fundamental factors (e.g., economic data, earnings, or news events)

- Risk management principles (e.g., position sizing, stop-loss levels)

A trading strategy is your specific method for deciding when to enter and exit trades.

It defines what you trade, why you trade it, and how you manage risk.Example Components of a Trading Strategy:

Your strategy is built on rules and analysis, often combining:

- Technical indicators (e.g., RSI, moving averages, Fibonacci levels)

- Fundamental factors (e.g., economic data, earnings, or news events)

- Risk management principles (e.g., position sizing, stop-loss levels)

Trading style vs trading strategy: what is the difference?

In short, your style is the framework, but your strategy is the playbook.

Think of it this way:

- Your trading style decides how often you step onto the field

- Your trading strategy decides how you play the game.

Trading style Vs Trading strategy in depth

Trading Style in depth

Now that we’ve covered the basics of what trading styles are, let’s take a closer look at each one. Every style comes with its own pace, mindset, and level of involvement. Let’s break them down one by one.

Position Trading:

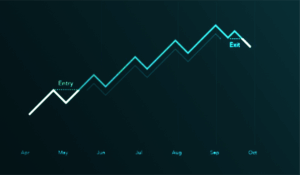

Position trading involves holding a trade for a long period of time, whether its weeks, months, or even years. Position traders are not concerned with short-term markets; instead, they focus on the broader market trend and long-term opportunities.

Investing is often seen as the closest form of position trading. However, while investors usually follow a “buy and hold” approach, position traders can take both long and short positions, aiming to profit from major market moves in either direction.

Position trading typically involves opening fewer trades than other trading styles, but with larger position sizes. This increases the potential for higher profits, but also raises exposure to risk. Traders following this style need a great deal of patience and discipline to follow their plan, knowing when to let profits run and when to close a position.

Position traders often use a combination of fundamental and technical analysis to support their decisions, relying on tools such as trendlines, moving averages, and Fibonacci retracements to identify potential entry and exit zones.

Key characteristics of position trading:

- Positions are held for weeks, months, or even years.

- Focuses on long-term trends

- Requires tolerance for temporary market volatility.

- Involves setting wider stop-loss levels to allow trades room to move.

Position trading is ideal for traders who prefer a slower, more patient approach to the markets — one that prioritizes major trends over daily price noise.

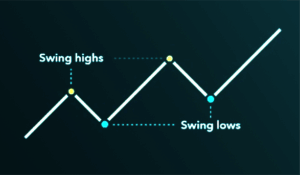

Swing trading

Swing trading is a trading style that focuses on capturing short- to medium-term market movements. It involves holding trades for several days or weeks, aiming to profit from the natural “swings” in price — the rises and falls that occur within a broader trend.

The main goal of swing trading is to identify an ongoing trend and take advantage of the temporary pullbacks or rallies within it. Swing traders rely heavily on technical analysis to find these key turning points in the market. They look for:

- Swing highs — when prices reach a short-term peak and start to pull back.

- Swing lows — when prices decline and then begin to recover.

A swing low may signal an opportunity to buy into a long position, while a swing high can be used to sell or take a short position. Swing traders often focus on markets with strong momentum and healthy volatility, as these conditions create more frequent and tradable swings.

Unlike day traders who close all positions before the session ends, swing traders are comfortable holding trades overnight or even through weekends if the setup supports their plan. This approach gives them more time to analyse, plan, and react, without the constant need to monitor charts throughout the day.

Key characteristics of swing trading:

- Positions are usually held for a few days to a few weeks.

- Relies mainly on technical analysis, chart patterns, and momentum indicators.

- Aims to enter trades near key support or resistance levels.

- Involves moderate risk and requires a balanced mix of patience and decisiveness.

- Exposure to overnight or weekend risk is higher than in day trading.

Swing trading suits traders who enjoy analyzing the markets but prefer not to spend their entire day in front of screens. It offers a balance between the fast pace of day trading and the patience of long-term position trading — making it a practical choice for those seeking flexibility with strategy and time.

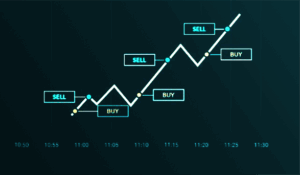

Day trading

Day trading is a trading style where traders open and close all their positions within the same trading day. The goal is to profit from short-term price movements — small fluctuations that happen throughout the day — without holding trades overnight. By closing all positions before the market ends, day traders avoid the risks and costs that come with overnight exposure.

This trading style requires focus, speed, and strong discipline. Day traders often execute multiple trades a day, aiming for smaller but more frequent profits. Because of this, every decision must be calculated, and losses need to be controlled immediately. The use of stop-loss and take-profit levels is essential to protect capital and lock in gains.

Day traders rely primarily on technical analysis to spot intraday opportunities. They monitor price charts, trading volume, and market momentum to react quickly to price shifts — often triggered by economic data, breaking news, or short-term volatility.

Key characteristics of day trading:

- Positions are opened and closed within a single trading day.

- Focused on intraday price movements and short-term volatility.

- Involves frequent trades with smaller profit targets per position.

- Requires constant monitoring of charts and fast execution.

- High emphasis on liquidity and low spreads to manage costs.

Day trading is fast-paced and mentally demanding. It suits traders who can stay focused for long hours, make quick decisions under pressure, and control their emotions even during intense market moves.

Because trades are short-lived, this style doesn’t require the patience of position trading — but it demands precision, consistency, and strict risk management. For those who thrive in a fast, dynamic environment, day trading offers the thrill and challenge of being in the market every second it moves.

Scalping

Scalping is the fastest and most intense trading style — it involves opening and closing positions within seconds or minutes to capture very small price movements. The goal is simple: take small but consistent profits throughout the day before the market has time to reverse.

This style is often seen as an accelerated form of day trading. Scalpers rely on highly liquid markets — such as major forex pairs or index futures — where they can enter and exit positions instantly without large spreads or slippage. Because trades happen so quickly, execution speed and precision are everything.

Scalping demands constant focus, quick decision-making, and emotional control. There’s no time for hesitation or second-guessing — each trade must be planned, executed, and exited within moments. The strategy works on volume and frequency; small profits from many trades can add up significantly over time.

Key characteristics of scalping:

- Trades last only a few seconds to a few minutes.

- Focuses on small, frequent profits rather than large single gains.

- Requires extremely high liquidity and low transaction costs.

- Demands full concentration and fast reflexes.

- Involves tight stop-losses and disciplined execution.

While scalping can be profitable, it’s also one of the most demanding and stressful trading styles. The need for rapid reactions and continuous monitoring can make it unsuitable for part-time traders or those who prefer a slower pace.

Scalpers must also be aware of costs — commissions, spreads, and slippage can quickly eat into small profits if not managed carefully. Strong risk management and technical precision are essential for success.

In short, scalping is for traders who thrive under pressure, enjoy fast action, and have the discipline to make quick, precise decisions in a constantly moving market.

Arbitrage Trading

Arbitrage trading exploits price discrepancies of the same asset across different markets or instruments.

- Goal: Lock in risk-free profits from temporary market inefficiencies.

- Execution: Requires high-speed technology, deep liquidity, and large capital.

- Example: Buying an asset on one exchange and selling it simultaneously on another at a higher price.

- Used By: Institutional traders and hedge funds due to infrastructure and cost needs.

Event-Driven Trading

This style seeks to profit from market reactions to major events — such as mergers, earnings reports, or geopolitical developments.

- Focus: Anticipating volatility around scheduled or unexpected events.

- Approach: Combines technical and fundamental analysis to predict post-event price movement.

- Example: Trading before or after a company’s quarterly earnings announcement.

Quantitative Trading

Quantitative trading relies on mathematical models and algorithmic systems to identify trading opportunities.

- Basis: Statistical patterns, data modeling, and probability-based forecasts.

- Tools Used: Algorithms, programming languages (Python, R, C++), and historical backtesting.

- Practitioners: Quantitative analysts (“quants”) and institutional desks.

- Goal: Remove human bias and achieve systematic, data-driven decision-making.

High-Frequency Trading (HFT)

HFT is a subset of quantitative trading focused on executing a large number of orders in milliseconds.

- Speed: Ultra-fast order execution powered by advanced algorithms and low-latency connections.

- Participants: Mainly large financial institutions and hedge funds.

- Risk: Minimal per trade but very high cumulative exposure due to volume.

- Note: Not suitable for retail traders due to infrastructure and cost.

How to Choose Your Trading Style

Choosing the right trading style depends on your goals, mindset, and resources.

Use these quick points as a guide

- Know yourself: Identify your personality — fast-paced or patient, analytical or intuitive.

- Time commitment: Decide how much time you can realistically dedicate to trading.

- Capital available: The more capital you have, the easier it is to hold long-term positions.

- Risk tolerance: Match your style to how much volatility and loss you can handle.

- Trading goals: Short-term income or long-term wealth growth — each needs a different style.

- Lifestyle fit: Pick a style that complements your routine, not one that disrupts it.

- Test first: Try different styles in a demo account before committing real funds.

Trading Style Comparison Table

| Personality Type | Trading Style | Average Holding Period | Time Commitment | Capital Requirement | Risk Tolerance | Best For |

| Fast-paced, decisive, thrives under pressure | Scalping | Seconds to minutes | Extremely high (constant monitoring) | Medium | Very high | Traders who enjoy fast execution and instant results |

| Focused, analytical, enjoys active engagement | Day Trading | Minutes to hours (within same day) | High (full-day involvement) | Medium to high | High | Traders with full-time availability and emotional control |

| Patient, strategic, prefers balanced approach | Swing Trading | Several days to weeks | Moderate (check daily or few times a week) | Moderate | Medium | Part-time traders seeking a balance between activity and time freedom |

| Calm, long-term thinker, risk-averse | Position Trading | Weeks to months or years | Low (weekly analysis) | High | Low to medium | Investors focusing on macro trends and long-term returns |

| Strategic, data-driven, enjoys coding and analytics | Algorithmic/Quantitative Trading | Varies (automated) | Low to medium (system setup and maintenance) | High | Medium | Traders who prefer automation and logic over emotion |

| Opportunistic, news-oriented, adaptable | Event-Driven Trading | Hours to days | Medium (around events) | Medium to high | High | Traders following earnings, news releases, or market catalysts |

| Long-term visionary, prefers stability and fundamentals | Investing / Long-Term Trading | Years | Very low | High | Low | Individuals focusing on wealth growth and compounding returns |

Trading strategy in depth

Now that we’ve explored what trading strategies are, let’s dive deeper into how they work.

Trend Trading

Trend trading focuses on identifying and following the prevailing market direction — whether upward (bullish) or downward (bearish). Traders using this strategy aim to “ride the trend” for as long as possible, entering when the market confirms its direction and exiting when momentum fades.

Key Characteristics:

- Based on the principle that “the trend is your friend.”

- Uses technical indicators such as Moving Averages (MA), RSI, and ADX.

- Works best in markets with strong, sustained momentum.

- Ideal for: Swing traders and position traders.

Goal: Capture profits from extended market movements rather than small fluctuations.

Range Trading

Range trading capitalizes on markets that move between defined support and resistance levels. Traders buy near support and sell near resistance, taking advantage of predictable oscillations in price.

Key Characteristics:

- Effective in sideways or consolidating markets.

- Utilizes indicators like RSI, Stochastic Oscillator, and Bollinger Bands to detect overbought or oversold zones.

- Traders close positions when the price nears the opposite boundary of the range.

- Ideal for: Scalpers, day traders, and short-term swing traders.

Goal: Profit from price reversals within established boundaries.

Breakout Trading

Breakout trading aims to catch a new market trend at its very beginning. Traders enter positions when the price “breaks out” of a key level of support or resistance, signaling potential volatility and momentum.

Key Characteristics:

- Based on volume spikes and volatility expansions.

- Uses Volume Indicators, Moving Averages, or Bollinger Bands to confirm breakouts.

- Often employs limit-entry orders just beyond key price levels.

- Ideal for: Day traders and swing traders.

Goal: Capture profits from sharp movements that follow a price breakout.

Reversal Trading

Reversal trading identifies moments when a prevailing trend is likely to change direction. This strategy aims to enter early when momentum shifts from bullish to bearish or vice versa.

Key Characteristics:

- Focuses on price exhaustion and trend reversals.

- Uses tools like Fibonacci Retracements, MACD Divergence, and Candlestick Patterns.

- Requires patience and confirmation before entering to avoid false reversals.

- Ideal for: Experienced swing or position traders.

Goal: Profit from turning points in market sentiment.

Arbitrage Trading

Arbitrage trading exploits price discrepancies of the same asset across different markets or exchanges. Traders simultaneously buy at a lower price and sell at a higher one, locking in risk-free profit.

Key Characteristics:

- Relies on speed and execution rather than market analysis.

- Requires access to multiple exchanges and real-time pricing data.

- Often automated through algorithmic systems.

- Ideal for: Institutional or high-frequency traders.

Goal: Earn low-risk profits from inefficiencies in market pricing.

Event-Driven Trading

This strategy capitalizes on volatility created by significant market events such as earnings reports, central bank decisions, or geopolitical developments.

Key Characteristics:

- Combines fundamental and technical analysis.

- Focuses on catalysts like mergers, acquisitions, or economic announcements.

- Involves pre- and post-event positioning to capture market reactions.

- Ideal for: Traders who stay updated with financial news.

Goal: Profit from sharp price moves following major events.

Quantitative Trading

Quantitative trading relies on mathematical models and statistical algorithms to identify trading opportunities. It removes emotional decision-making and is often automated.

Key Characteristics:

- Uses data-driven algorithms for execution.

- Employs backtesting and statistical analysis.

- Requires strong programming and mathematical skills.

- Ideal for: Algorithmic and institutional traders.

Goal: Exploit statistical patterns and inefficiencies in the market.

News-Based Trading

This strategy takes advantage of immediate market reactions to breaking news — such as economic data releases, political announcements, or company reports.

Key Characteristics:

- Focuses on volatility spikes right after news events.

- Requires fast execution and understanding of how news affects sentiment.

- Traders often use economic calendars and news scanners.

- Ideal for: Active day traders with strong discipline.

Goal: Profit from short-term volatility following major news events.

Money Flow Trading

Money flow trading tracks where institutional money is moving — into or out of specific assets or sectors. Traders analyze volume data, fund flows, and open interest to anticipate trends.

Key Characteristics:

- Focuses on institutional trading patterns and liquidity.

- Uses Money Flow Index (MFI) and Volume Profile indicators.

- Best suited for medium- to long-term traders.

- Ideal for: Traders who follow macroeconomic capital flows.

Goal: Follow the “smart money” and align trades with institutional momentum.

Options Strategies

Options trading involves creating structured strategies using derivatives to profit from various market conditions — whether prices rise, fall, or remain flat.

Key Characteristics:

- Includes strategies like Covered Calls, Iron Condors, and Straddles.

- Balances risk and reward through defined payoffs.

- Can be used for hedging, speculation, or income generation.

- Ideal for: Experienced traders with a solid understanding of derivatives.

Goal: Generate returns while managing risk exposure through options combinations.

Algorithmic Trading

Algorithmic trading (Algo Trading) automates trading decisions based on predefined rules and conditions — such as price levels, volume, or time.

Key Characteristics:

- Eliminates human emotion from execution.

- Uses real-time data, AI, and machine learning models.

- Ideal for both institutional and advanced retail traders.

- Can execute multiple strategies simultaneously.

Goal: Optimize trading efficiency through speed, precision, and automation.

How to Choose Your Trading Strategy

Picking the right trading strategy depends on your objectives, market understanding, and preferred level of activity

Here’s how to choose wisely

- Define your goal: Are you looking for steady long-term growth or short-term profits?

- Match with your style: Choose a strategy that complements your trading style (day, swing, position, etc.).

- Know your strengths: Are you better at analyzing charts (technical) or economic factors (fundamental)?

- Understand the market: Not all strategies fit every asset — forex, stocks, and crypto behave differently.

- Check volatility: Some strategies work best in trending markets; others thrive in sideways ones.

- Set your risk limit: Choose a method that allows proper stop-loss and position sizing.

- Test before trading live: Backtest or demo trade to see how your strategy performs under real conditions.

Trading Strategy Comparison Table

|

Strategy Type |

Goal |

Time Frame |

Main Analysis Used |

Best For |

Risk Level |

|

Trend Trading |

Capture profits from long-term trends | Medium to Long-Term | Technical (MA, RSI, ADX) | Patient traders who follow macro trends |

Moderate |

|

Range Trading |

Trade between support & resistance levels | Short to Medium-Term | Technical (RSI, Bollinger) | Calm traders who prefer stable markets |

Low to Moderate |

|

Breakout Trading |

Profit from strong price moves | Short to Medium-Term | Volume & Price Action | Active traders who like momentum | Moderate to High |

|

Reversal Trading |

Catch early signs of market direction change | Short to Medium-Term | Technical (Fibonacci, RSI) | Analytical traders with good timing skills |

High |

|

Arbitrage Trading |

Exploit price differences across markets | Very Short-Term | Quantitative/Automated | Institutional or advanced algorithmic traders | Low (High capital needed) |

|

Event-Based Trading |

Trade price reactions to major events | Short-Term to Days | Fundamental + Technical | News-oriented traders |

High |

|

Quantitative Trading |

Use data & models to automate decisions | Varies (depends on model) | Statistical/Algorithmic | Mathematically inclined traders |

Moderate to High |

|

High-Frequency Trading |

Gain from micro price inefficiencies | Seconds to Minutes | Algorithmic | Institutions with fast infrastructure |

Very High (Tech-dependent) |

|

Options Strategies |

Manage risk or speculate using derivatives | Short to Medium-Term | Mathematical/Volatility-based | Traders comfortable with complex models |

Moderate to High |

|

Money Flow Trading |

Follow capital inflows & outflows | Medium to Long-Term | Volume/Fundamental Data | Macro-focused or institutional traders |

Moderate |

Wrap up

Trading styles and strategies work hand in hand — one shapes how you approach the market, while the other defines when and why you take action.

Your style sets the tempo of your trading journey, while your strategy determines the path you follow to reach your goals.

Some traders thrive on fast-paced decision-making; others succeed through patience and long-term positioning.

Extra tip: Try your trading style and strategy on a Demo Account for free, with zero risk.