Table of Contents

Inside the Amazing World of Trading Platforms

Welcome to the fascinating world of trading platforms, the powerful engines that connect traders to global financial markets. Whether you’re trading Forex, stocks, commodities, or cryptocurrencies, your trading platform is where every decision, analysis, and execution goes.

Think of it as the center of your investment, a place where technology meets opportunity. It’s where charts come alive, orders are placed in real-time, and strategies are tested against the pulse of global price movements. For both beginners and professionals, understanding how trading platforms work is the first real step toward mastering the art of trading.

In this guide, we’ll take you inside the amazing world of trading platforms , exploring what they are, how they function, the tools they provide, and how to choose the one that fits your style and goals.

By the end, you’ll not only understand the technology behind every trade, but also how to use your platform as a strategic advantage, whether you’re analyzing price action, setting up automated trades, or managing risk like a pro.

What Are Trading Platforms?

Electronic trading platforms are software systems used by traders to access major financial markets for the purpose of buying, selling, and managing investments online.

Through these platforms, investors can:

-

Open trading positions

-

Close trades instantly

-

Manage their portfolios and market exposure

All of this happens through the internet m via a licensed financial broker (online brokerage firm) that provides the platform.

The Role of the Broker

Most brokers offer these trading platforms for free or at minimal cost, often requiring users to maintain a funded account or execute a certain number of trades per month.

The broker acts as a bridge between you and the market, providing real-time data, liquidity, and order execution services.

The Importance of Understanding How to Use a Trading Platform for Beginners

Before you can trade effectively and make informed decisions, you must understand how your trading platform works.

The platform is your primary tool it’s where you analyze charts, track prices, and execute trades. Whether you’re a beginner or a professional trader, mastering your trading platform gives you:

-

Confidence in your trades

-

Faster and more precise order execution

-

Better control over your risk and capital

Types of Trading Platforms

Commercial Platforms

These platforms are designed for a wide range of investors, from day traders to long-term investors. They are user-friendly and come packed with essential features, including:

-

Live market quotes and pricing

-

Real-time global news feeds

-

Interactive, customizable charts

-

Educational materials

-

Advanced research and analysis tools

Proprietary (In-House) Platforms

Developed internally by large financial institutions or major brokerage firms for exclusive use by their traders or clients.

Tailored to institutional needs, offering:

-

-

Direct Market Access (DMA)

-

Custom-built analytical tools

-

Specialized order types

-

-

Not available to retail traders, as they are designed specifically for institutional environments.

Web-Based Platforms:

Accessible via browser, no downloads required. Perfect for flexibility and ease of use.

Mobile Platforms:

Apps for trading on the go, allowing full access to markets from smartphones and tablets.

Main Components of a Trading Platform

Every professional trading platform typically includes:

-

User Interface (UI):

Easy navigation and customizable layouts

-

Charts & Graphs:

For real-time technical analysis

-

Order Execution Tools:

Market, limit, stop, and conditional orders

-

Live Market Data:

Real-time price feeds and liquidity depth

-

Account Management Tools:

Track balances, positions, and performance

-

Security Systems:

Encryption and two-factor authentication

-

Direct Market Connection:

For instant order routing

-

Demo Account:

For risk-free practice

-

Integrated Support:

In-platform customer and technical assistance

Why Understanding How a Platform Works is essential?

Knowing how to use your trading platform helps you:

-

Build and test a trading strategy

-

Make smarter, data-backed decisions

-

Keep a detailed trading journal

-

Understand charts and technical indicators

-

Open and close trades with confidence

-

Use advanced order types (market, limit, stop-loss)

-

Set precise entry and exit levels

-

Manage risk effectively through stop-loss and take-profit tools

-

Practice trading safely through a free demo account before risking real money

What Trading Platforms Allow You to Do?

Through modern trading platforms, you can:

-

Access multiple markets including Forex, stocks, commodities, and cryptocurrencies

-

Execute trades instantly with high precision

-

Monitor real-time price data and technical indicators

-

Manage risk using built-in tools like stop-loss and take-profit

-

Stay informed with integrated news feeds and alerts

What Makes These Platforms Stand Out?

-

Broker Flexibility:

These platforms aren’t tied to a single broker — traders can connect their accounts to multiple brokers around the world, making it easier to compare spreads, execution quality, and trading conditions.

-

Multi-Asset Access:

They provide access to a wide range of asset classes, including forex, commodities, indices, cryptocurrencies, and stocks, allowing traders to diversify their portfolios within a single platform.

-

Comprehensive Trading Options:

Support for both manual and automated trading, giving traders the freedom to execute trades directly or use expert advisors (EAs), bots, and algorithmic strategies for greater precision and efficiency.

-

Advanced Analytics and Backtesting:

Equipped with powerful charting tools, custom indicators, and strategy testing environments that let traders design, test, and optimize their strategies using historical market data before going live.

-

Cross-Device Compatibility:

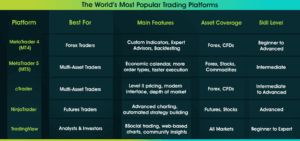

Most leading platforms (like MetaTrader 4, MetaTrader 5, and cTrader) are available on desktop, web, and mobile, ensuring smooth access and real-time synchronization across devices.

-

Global Community and Support:

A vast global user base means continuous development, thousands of plugins, and an active online community offering scripts, indicators, and trading systems — something exclusive or proprietary platforms rarely offer.

How to Choose the Right Trading Platform

Choosing the right trading platform can make or break your trading experience. Consider these key factors:

-

Ease of use and intuitive design

-

Availability of advanced charting and analysis tools

-

Speed of order execution

-

Transaction costs, spreads, and hidden fees

-

Demo account availability

-

Quality of customer support and responsiveness

-

Compatibility with your trading style (scalping, swing trading, long-term investing)

What to Look for in a Trading Platform

To ensure you’re trading efficiently, look for platforms that include:

-

One-click trading:

-

Multi-device synchronization:

Access your account from desktop, web, and mobile

-

Customizable alerts and notifications:

Stay on top of price changes

-

Risk management tools:

Margin indicators, exposure reports, and account summaries

-

Backtesting environment:

Test your strategies before going live

Understanding Trading Symbols

Every symbol on the platform represents a financial instrument (for example:

-

EUR/USD for the Euro vs. the U.S. Dollar

-

TSLA for Tesla stock

Understanding trading symbols helps you:

-

Choose the right asset to trade

-

Track price movements accurately

-

Avoid mistakes by trading the wrong instrument

The Role of Mobile Trading Apps

In today’s fast-moving markets, mobile trading apps have become essential. They allow you to:

-

Trade anywhere, anytime

-

Monitor open positions 24/7

-

Receive instant alerts on price movements and market news

-

React quickly to breaking events that move markets

Tips to consider Before You Start Trading

-

Always start with a demo account before risking real money

-

Begin trading with a small balance

-

Learn risk and money management principles

-

Always use stop-loss and take-profit orders

-

Keep a trading journal to track your progress and learn from experience

Wrap up

Trading platforms are the bridge between you and the global financial markets. Mastering how they work is the foundation of every successful trader’s journey.

If you’re new to trading, don’t rush into live markets right away. Start with a free demo account to experience real market conditions — without financial risk.

This will help you understand how platforms behave during volatility, how fast prices move, and how it really feels to execute trades in real time.

Once you’re confident, you’ll be ready to move from simulation to live trading , with skill, discipline, and strategy.