Table of Contents

The Ultimate Currency Pairs Cheat Sheet

Yes, you read that right. This is your ultimate guide to currency pairs , the foundation of the entire Forex market.

We’re about to break down every type of currency pair, from the major players that dominate global trading to the lesser-known exotics that add excitement and volatility to the mix.

But before we dive into the categories and what makes each one unique, let’s start from the very beginning. What exactly is a currency pair, and why is it so important in Forex trading?

Don’t worry, we’ve got you covered. By the end of this guide, you’ll not only understand how currency pairs work but also know which ones fit your trading style, risk tolerance, and goals.

Let’s dive in.

What Is a Currency Pair?

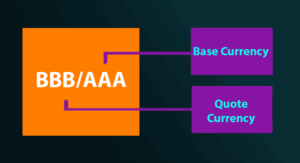

A currency pair represents the exchange rate between two different currencies, showing how much of one currency (the quote currency) is needed to buy one unit of another (the base currency).

For example, in the EUR/USD pair, the euro (EUR) is the base currency and the U.S. dollar (USD) is the quote currency. Currency pairs form the foundation of Forex trading, allowing traders to compare the strength and value of one currency against another.

What Are Currency Pairs in Forex Trading?

In the Forex market, all trading happens in pairs of currencies, known as currency pairs. A currency pair represents the value of one currency against another — showing how much of one currency (the quote currency) is needed to purchase one unit of the other (the base currency).

For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quoted currency. If the pair is trading at 1.1250, it means one euro is worth 1.1250 U.S. dollars.

When you trade Forex, you’re always buying one currency while selling another — it’s a simultaneous transaction. Buying EUR/USD means you’re buying euros and selling U.S. dollars; selling it means the opposite.

Currency pairs are quoted using three-letter codes set by the ISO (International Organization for Standardization), making them universally recognized.

Some of the most traded pairs in the world — often called major pairs — include:

-

EUR/USD (Euro / U.S. Dollar)

-

GBP/USD (British Pound / U.S. Dollar)

-

USD/JPY (U.S. Dollar / Japanese Yen)

-

USD/CHF (U.S. Dollar / Swiss Franc)

Each pair reflects the economic relationship between two countries, influenced by interest rates, inflation, political stability, and global demand.

In essence, currency pairs are the foundation of Forex trading — they tell you how much one currency is worth in terms of another and serve as your gateway to the world’s largest financial market. Understanding how they work is the first step toward making smart, informed trading decisions.

After learning about the idea of a currency pair, let’s get a bit deeper and learn that these pairs are categorized into three main types.

What Is the Base Currency?

The base currency is the first currency in the pair, and the second is the quote currency.

It tells you how much of the quote currency is needed to buy one unit of the base currency.

Example: EUR/USD = 1.25 → €1 = $1.25.

What Is the Quote Currency?

The quote currency is the second currency in the pair, while the first is the base currency.

It shows how much of this currency is needed to purchase one unit of the base currency.

Example: EUR/USD = 1.25 → it takes $1.25 (quote currency) to buy €1 (base currency).

Categories of Currency Pairs in Forex Trading

In the world of Forex, not all currency pairs are created equal. Some move steadily and are highly liquid, while others are volatile and unpredictable.

To make sense of this vast market, traders group pairs into three main categories:

-

Major pairs

-

Minor (cross) pairs

-

Exotic pairs

Each category has its own rhythm, trading behavior, and risk profile. Understanding how they work is key to choosing the right pair for your trading goals and strategy.

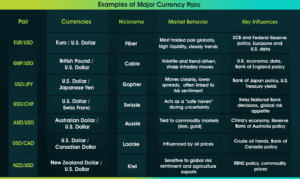

Major Currency Pairs

Major currency pairs — often called “the majors” — are the backbone of the Forex market. They all include the U.S. dollar (USD) on one side, paired with another leading global currency.

These pairs represent the most traded and liquid instruments in the world, accounting for over 80% of daily Forex volume.

Because they’re heavily traded, they tend to have tight spreads, smooth price action, and plenty of market data — making them ideal for both beginners and professionals.

How Major Currency Pairs Work

-

Each pair shows how much of the quote currency is needed to buy one unit of the base currency.

-

They are strongly influenced by global macroeconomic indicators such as interest rates, inflation, and central bank policy.

-

Liquidity is extremely high, allowing for fast trade execution and minimal slippage.

-

Volatility tends to be moderate — offering consistent movement without excessive unpredictability.

Why Trade Major Pairs?

- Lowest transaction costs

- High liquidity and tighter spreads

- Abundant data and predictable reactions to economic events

- Ideal for both short-term and long-term strategies

The Four Traditional Majors

The four traditional major pairs are:

-

EUR/USD

-

USD/JPY

-

GBP/USD

-

USD/CHF

Below is a quick look at what drives each pair.

Trading EUR/USD

The most traded pair in the world. It tends to be less volatile due to strong economies on both sides but reacts to major geopolitical and monetary events.

Trading USD/JPY

Known for clean movements and strong ties to interest rate differentials. The yen is often used in carry trades and is a safe-haven currency.

Trading GBP/USD

Called “Cable,” this pair is known for sharp intraday moves and high sensitivity to U.K. political and economic news.

Trading USD/CHF

A safe-haven pair. The Swiss franc strengthens during market uncertainty and follows eurozone trends during stability.

Commodity Currencies

Commodity currencies are those whose values are heavily tied to the price of key exports such as oil, coal, or metals.

The three most notable “commodity currency” pairs are AUD/USD, USD/CAD, and NZD/USD.

Trading AUD/USD

Closely linked to coal, iron ore, and copper prices. China’s economy and Reserve Bank of Australia policy are key drivers.

Trading USD/CAD

Strongly influenced by oil prices. When crude oil rises, CAD strengthens. Watch OPEC decisions and energy market trends.

Trading NZD/USD

Reflects agricultural and commodity dependence. The RBNZ’s rate decisions and global risk appetite have big effects.

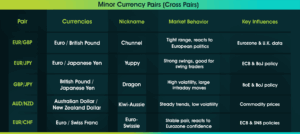

Minor Currency Pairs (Cross Pairs)

Minor currency pairs or cross pairs are the pairs that do not include the U.S. dollar.

They connect other major currencies like EUR, GBP, JPY, and CHF, showing relationships between major economies.

Why Trade Minor Pairs

- Offer strong directional trends not tied to USD

- Great for regional economic plays

- More volatility = more opportunity (but higher risk)

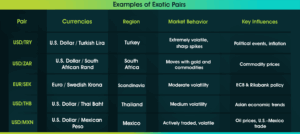

Exotic Currency Pairs

Exotic pairs combine one major currency with a currency from an emerging or developing economy.

They offer larger potential moves but come with higher spreads and volatility.

Why Trade Exotic Pairs

- Potential for large percentage moves

- Great for traders following emerging market news

- Can diversify your portfolio beyond USD pairs

- Caution: High volatility and wide spreads can amplify losses if not managed properly.

Additional Currency Groups

-

G10 Currencies: The ten most traded and liquid currencies in the world.

-

The Scandies: Scandinavian currencies — SEK, NOK, DKK — often tied to European trends.

-

CEE Currencies: Central and Eastern Europe — PLN, HUF, CZK, RON.

-

BRICS+: Brazil, Russia, India, China, South Africa — now expanded to include Egypt, Saudi Arabia, UAE, Iran, Ethiopia, and Indonesia.

Most Commonly Traded Currencies

The six most traded currencies globally are:

- USD

- EUR

- JPY

- GBP

- CHF

- AUD

Together, they cover about 90% of total Forex volume, with EUR/USD leading the way.

How to Buy and Sell Currency?

-

Bid Price: The price to buy.

-

Ask Price: The price to sell.

-

Spread: The difference between the two (the broker’s profit).

Example:

Bid/Ask = 1.2100 / 1.2300 → Spread = 0.02

What Is a Quotation?

A quotation is the price of a currency.

-

Direct Quotation: Price per USD in another currency.

-

Indirect Quotation: Price per unit of another currency in USD.

Best Currency Pairs to Trade

-

EUR/USD – High volume, low spreads, great for Eurozone exposure.

-

USD/JPY – Predictable moves, low spreads, strong central bank impact.

-

GBP/USD – Volatile and event-driven.

-

USD/CNY – Reflects U.S.–China economic relations.

-

USD/CAD – Oil-sensitive, good for commodity traders.

Tips to Choose the Right Currency Pair for You

-

Start with the majors – They’re the most liquid and predictable.

-

Match your timezone – Trade pairs that are most active during your local trading hours.

-

Watch spreads – Stick to low-spread pairs if you’re day trading or scalping.

-

Understand the economies – Choose pairs linked to regions or commodities you can follow easily.

-

Mind volatility – Beginners should avoid highly volatile exotics until they gain experience.

-

Test first – Use a demo account to understand each pair’s rhythm before going live.

Wrap-Up

Understanding currency pairs is the foundation of successful Forex trading.

Each pair tells a story about the relationship between two economies, their growth, stability, and market perception.

Now that you know how pairs work and how to categorize them, it’s time to take the next step.

Open a demo account and try trading different pairs to see which suits your style best.

When you’re ready to trade for real, open your live accounot and start your journey in the global Forex market.