Table of Contents

The Evolution of Gold

How It Became the World’s Ultimate Safe Haven

Gold has always been more than just a metal — it is the ultimate safe haven asset. In times of uncertainty, when markets tremble and currencies lose value, gold consistently shines as a store of wealth and a symbol of security. For centuries, investors and civilizations alike have trusted gold to safeguard their future, turning to it when everything else seemed unstable.

But what makes gold so powerful? How did it evolve from a decorative treasure of ancient kings to the cornerstone of financial security worldwide? In this article, we’ll take a journey through history to explore the evolution of gold and how it earned its place as the world’s most trusted safe haven.

Let’s dive in,

The History of Gold

Ancient Times

- 3600 BC

Gold is first smelted in ancient Egypt.

- 2600 BC

Egyptian hieroglyphs describe gold as being “more plentiful than dirt”. The earliest known gold mine map is created, and the first gold jewelry appears.

- 1223 BC

Tutankhamun’s funeral mask is crafted using gold.

The Birth of Gold Coins

- 600 BC

The first gold coins are struck in Lydia, Asia Minor (a crude mix of gold and silver).

- 560 BC

The Lydians refine gold and silver, creating the world’s first bi-metallic coinage, known as Croesids after King Croesus.

- 546 BC

Persians capture Lydia and adopt gold as their main coin metal.

- 500 AD

In China, the state of Chu circulates the Ying Yuan, a square gold coin.

Medieval & Renaissance Periods

- 1300

Hallmarking begins at Goldsmith’s Hall in London.

- 1370–1420

Europe experiences The Great Bullion Famine as mines are nearly depleted.

- 1489

The first gold Sovereign is struck under King Henry VII.

Gold Standards & Industrial Revolution

- 1717

The UK sets the gold standard, linking currency to gold at a fixed rate.

- 1816

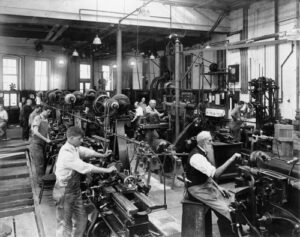

The Industrial Revolution transforms coin production with steam-powered presses by Matthew Boulton and James Watt. The Royal Mint relocates to Tower Hill.

- 1848

The California Gold Rush begins when James W. Marshall discovers gold at Sutter’s Mill.

- 1870–1900

Most of the world (except China) adopts the gold standard.

20th Century: Gold & Global Finance

- 1914

Countries move to fractional gold standards during WWI to fund war expenses.

- 1944

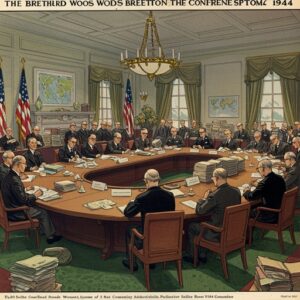

The Bretton Woods Agreement establishes fixed exchange rates. Gold remains a reserve currency, but the U.S. dollar becomes the dominant global reserve.

- 1971–73

President Nixon ends Bretton Woods, cutting the direct link between currencies and gold.

Modern Era

- 1999

The first Central Bank Gold Agreement (CBGA) caps European gold sales.

- 2010

World Bank president suggests a return to the gold standard.

- 2014

The Royal Mint launches a bullion trading platform.

- 2015

Royal Mint Refinery gold bars reintroduced after 50+ years. Digital Gold is also launched.

- 2020

The Royal Mint launches RMAU, a physically-backed gold ETF, on the London Stock Exchange.

From Ancient Trade to Modern Markets: Gold’s Evolution into the Safe Haven King

Trading has been at the core of human civilization since the earliest barter systems. Ancient societies exchanged grain, livestock, and tools — but gold stood out as the universal medium of exchange.

- In the 7th century B.C., the Lydians introduced gold coins, making gold central to commerce.

- During the Age of Exploration, Spanish conquests in the New World brought massive inflows of gold to Europe.

- The 19th-century gold rushes in California, South Africa, and Australia transformed global economies.

The Gold Standard of the 19th and early 20th centuries formally linked currencies to gold, making it the ultimate anchor of financial trust. Even after the U.S. abandoned the Gold Standard in the 1970s, gold retained its position as a store of value during crises.

Gold’s Biggest Competitors as Safe Havens

While gold holds the crown, it isn’t alone in the safe haven arena. Investors often diversify into other assets that also protect wealth during turbulence:

- The U.S. Dollar (USD):

- Global reserve currency.

- Strengthens during crises.

- Weakness: tied to U.S. monetary policy and debt.

- Swiss Franc (CHF):

- Backed by Switzerland’s neutrality and financial stability.

- Reliable but less liquid than gold or USD.

- Japanese Yen (JPY):

- Safe haven due to Japan’s strong creditor position.

- Popular in risk-off trading but affected by domestic economic stagnation.

- U.S. Treasury Bonds:

- Considered “risk-free” assets.

- Provide yield and safety.

- Still dependent on U.S. fiscal health.

- Bitcoin & Digital Assets:

- Dubbed “digital gold” with limited supply.

- Attractive to younger investors.

- High volatility makes it far less stable than gold.